Calstrs retirement calculator

Use this supplemental savings calculator to see your potential account value at age 65. Adds two years of service credit to Defined Benefit members who are eligible to retire.

2

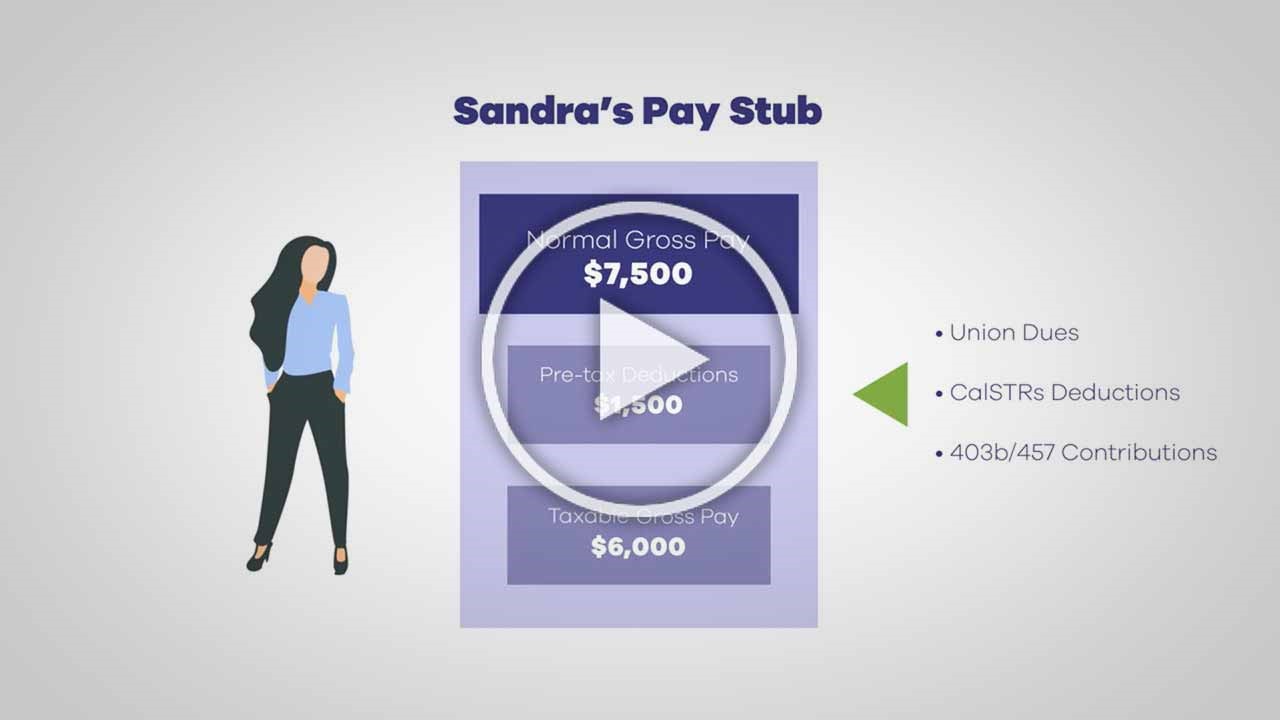

Change your state and federal tax withholding preferences.

. Seventy-five percent of your monthly annuity payment will be paid to your annuity beneficiary upon your death. CalSTRS 2 at 62. CalSTRS 2 at 60.

This calculator illustrates the principal of time and compounding. Log in now to. Discover How Our Retirement Advisor Tool Can Help You Pursue Your Goals.

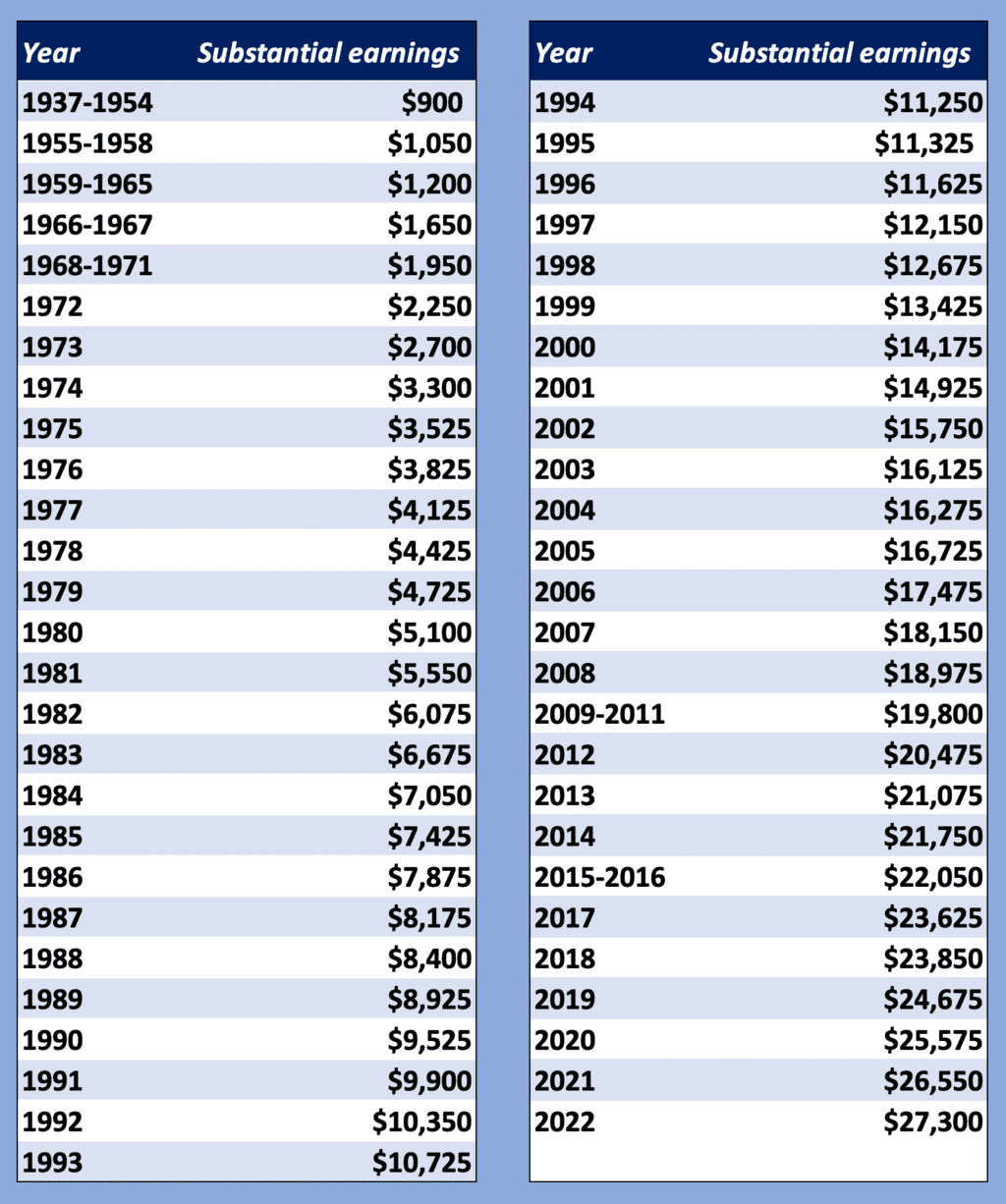

2 To estimate how your pension may compare to a Social Security retirement benefit use this Calculator. Ad Get Personalized Action Items of What Your Financial Future Might Look Like. Interest credited on both principal and previously credited interest.

Can increase the service credit used in calculating your service retirement benefit. More information on the Retirement Incentive Program is available in the Member Handbook and Retirement Incentive Program FAQ. This calculator is provided as a retirement planning tool to help you estimate your future retirement benefit.

This choice provides a monthly annuity payment for your lifetime and the lifetime of your annuity beneficiary. Based on your years of service credit and highest earnings. The more time you have the greater the benefit of compounding.

CalSTRS is the largest education-related pension program in the world and the second-largest pension fund in the entire United States with 3067. A program provided by employers that. Change your state and federal tax withholding preferences.

Each calculation can be used individually for. Estimate Your Retirement Benefits Read the disclaimer before using this calculator. Visit the CalPERS Twitter page.

If your beneficiary dies first your payment will rise to the Member-Only annuity amount. At present its unfunded liability is officially estimated at 71 billion. AARPs Free 3-Minute Chat Can Help You Plan Your Income For When You Retire.

Manage your beneficiary recipient designations. Access your Retirement Progress Report. The video shows how to generate an estimate of your CalSTRS monthly retirement benefit online.

The California State Teachers Retirement System CalSTRS is Californias 2nd largest public employee pension fund serving roughly 2 of Californias population. My CalSTRS is your online resource to access and manage your personal information on file with CalSTRS. On average CalSTRS retirees collect 90 more than the equivalent Social Security recipient.

Use the CalPERS online calculator. See the difference a few years can make. Estimate based on CalSTRS 2 at 60 benefit structure.

30 service credits x 3 benefit factor x 100000 final compensation If you want a rough estimate of your final compensation use a Time Value of Money calculator and follow the instructions here. Visit the CalPERS Facebook page. Dont Wait To Get Started.

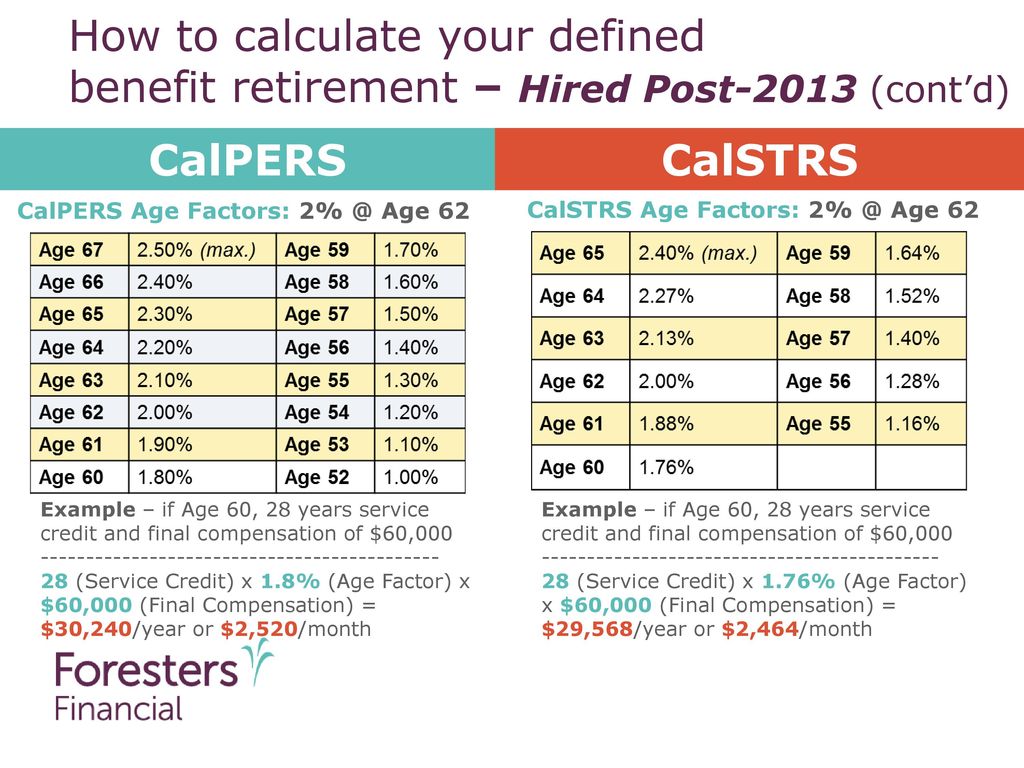

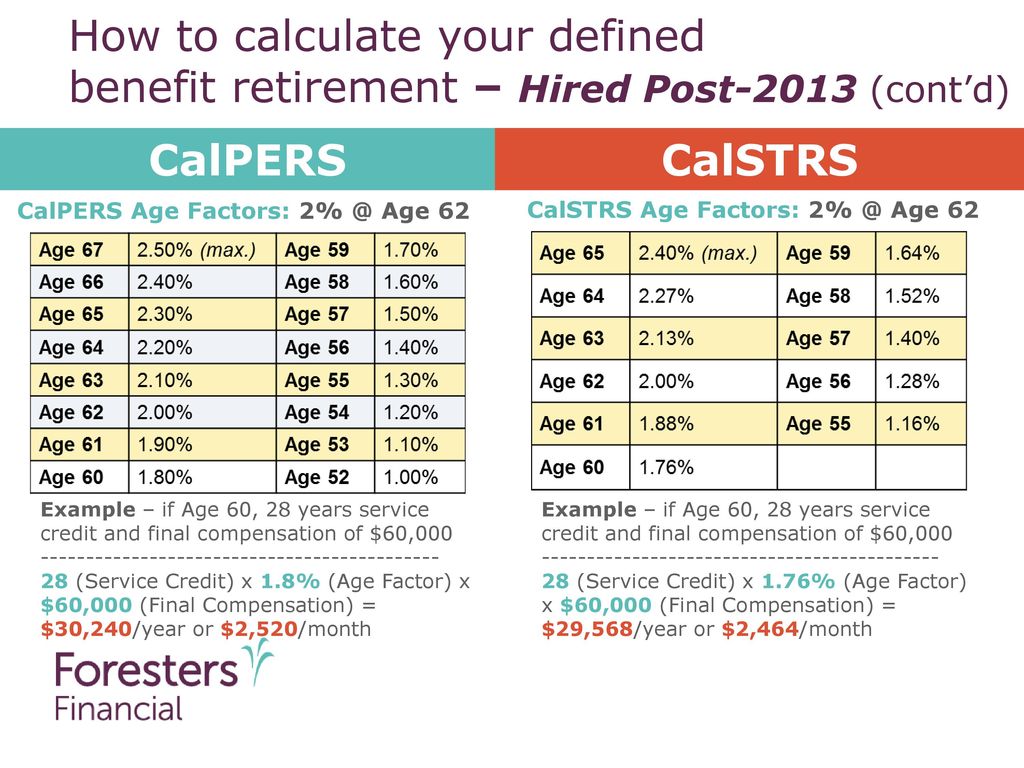

While much of the discussion over pension reform focuses on projected rates of investment returns which greatly. Ad TIAA Can Help You Create A Retirement Plan For Your Future. Service Credit x Age Factor x Final Compensation.

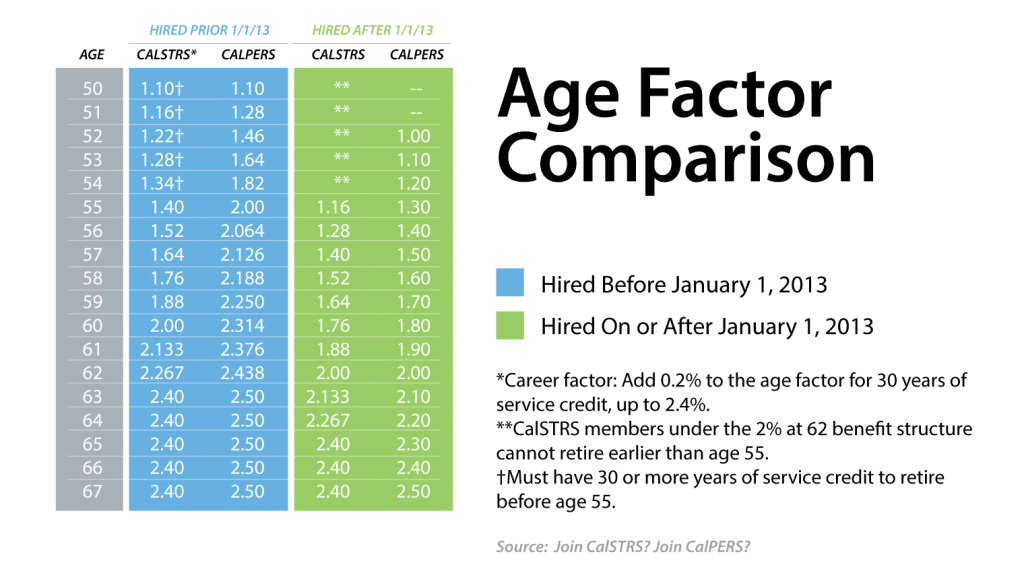

The date you want to retire. You were first hired before 01012013 or were a member of a concurrent retirement system before 01012013 and you performed service under that system within six months of becoming a CalSTRS member. Access your Retirement Progress Report.

View your account balances. The formula to calculate your Member-Only Benefit Retirement Benefit is simple. Percentage based on your age at the time you retire.

Log in now to. My CalSTRS is your online resource to access and manage your personal information on file with CalSTRS. Complete and submit CalSTRS forms electronically.

Years of Credited Service you expect. Calculations are estimates only. Number of school years you worked and paid into CalSTRS.

It stands for California State Teachers Retirement System and was established in 1913 to provide retirement benefits to California educators. Manage your beneficiary recipient designations. View your account balances.

Calculate your Retirement Benefit. Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. More in Service Disability Retirement.

Free calculators that help with retirement planning with inflation social security life expectancy and many more factors being taken into account. Home financial retirement calculator. You were first hired on or after 01012013.

Our Resources Can Help You Decide Between Taxable Vs. If you are age 50 at retirement. CalSTRS is Californias pension plan for teachers.

Complete and submit CalSTRS forms electronically. June 29 2015. In contrast CalPERS retirees receive a pension up to 5 times greater than Social Security payouts for individuals with an equivalent working history and age.

Our Retirement Calculator can help a person plan the financial aspects of retirement.

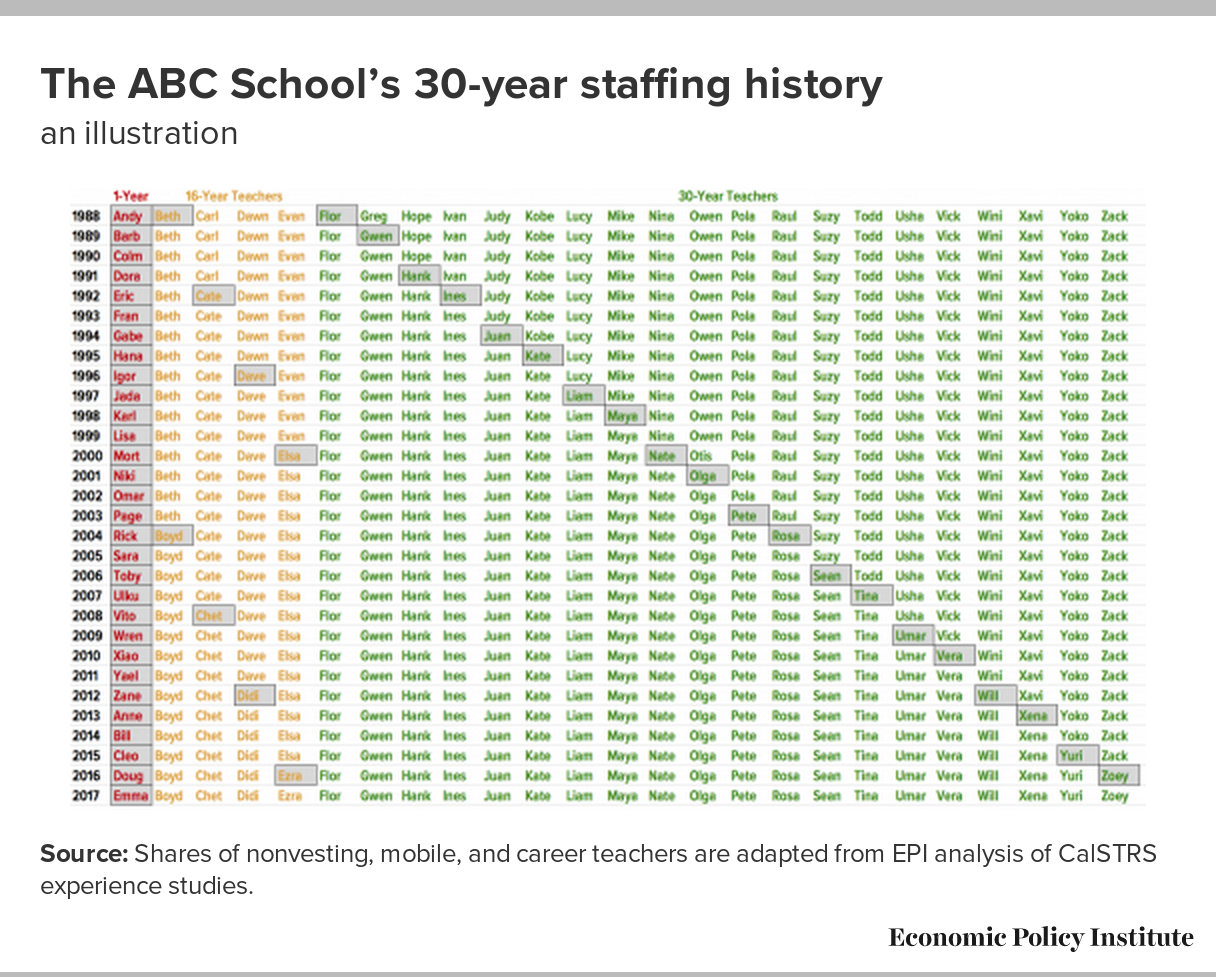

Teachers And Schools Are Well Served By Teacher Pensions Economic Policy Institute

Calstrs How To Estimate Your Retirement Benefit Facebook By Calstrs

Calpro Network Calculate Your Calstrs Pension

Are Annual Contributions Into Calstrs Adequate

Overview Of Calstrs

Calstrs How To Estimate Your Retirement Benefit Facebook By Calstrs

Overview Of Calstrs

2

Comparing Calstrs Pensions To Social Security Retirement Benefits

Retirement Benefits Calculator Youtube

Calstrs And Divorce A Helpful Guide 2022 Survive Divorce

Planmember Calstrs And Calpers Retirement Benefits

Calpro Network Calculate Your Calstrs Pension

2

California Public California State Employees Teachers Ppt Download

All About Your California Calstrs Pension A Teacher S Guide To Personal Finance

Teacher S Retirement And Social Security Social Security Intelligence